AIR Parametric is a specialty insurance provider delivering parametric insurance solutions for businesses impacted by lost revenue due to the devastation caused by extreme weather events.

Our proprietary products and pricing models utilize independently reported geospatial weather data and leading AI technology. By monitoring the weather 24/7, we ensure transparency of outcomes and a simplified process for customers and distribution partners.

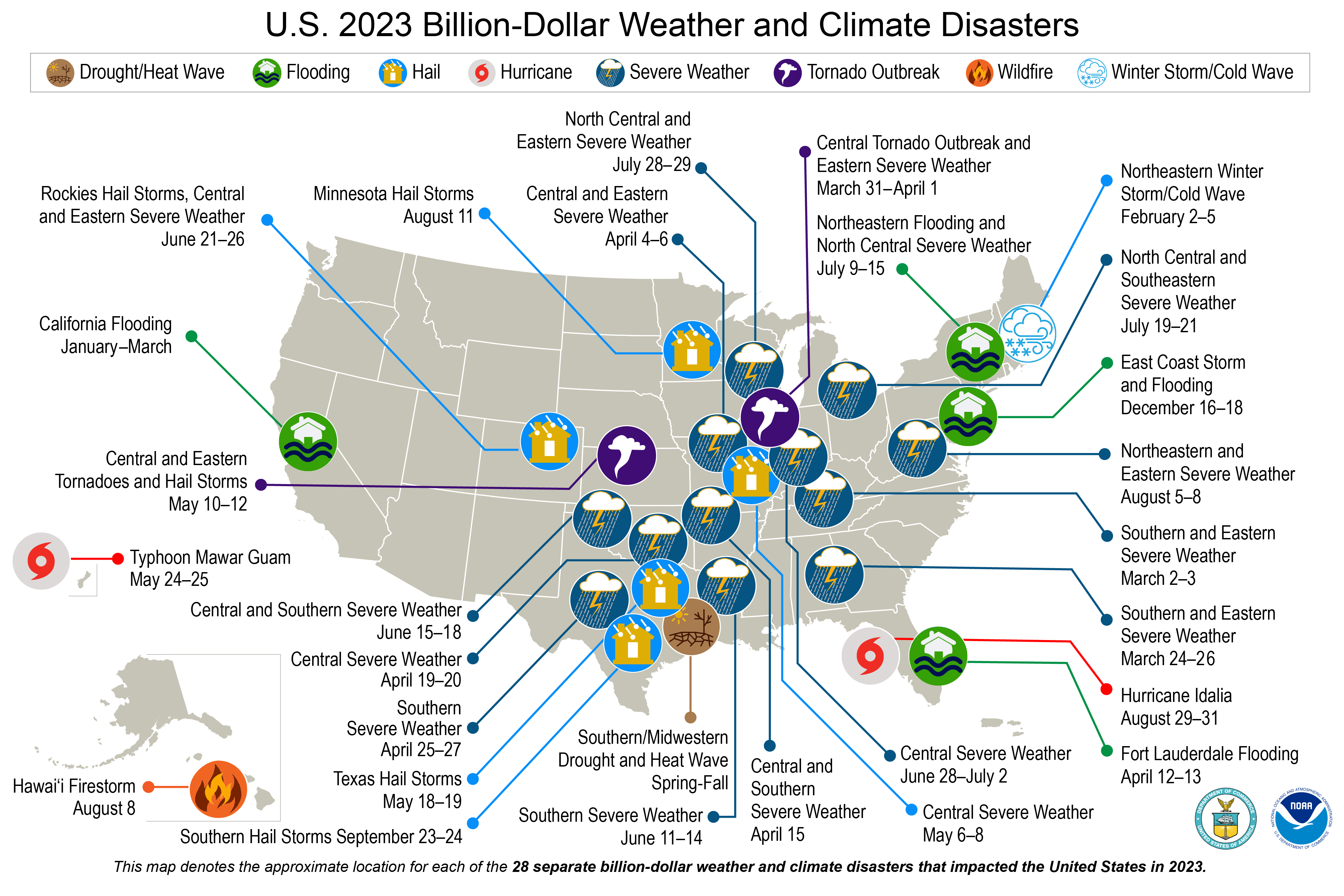

It’s real: extreme weather events are increasing, rapidly expanding business risks and expenses associated with extreme weather.

"In 2023, extreme weather caused $114 billion in US economic loss."

- AON 2024 Weather, Climate and Catastrophe Insight

Traditional commercial weather-related risk coverage is limited to events that cause physical damage, such as fire and flooding. AIR Parametric’s products, powered by our AI-enhanced state-of-the-art weather data platform, fill uncovered gaps when weather events like extreme heat, deep freeze or wildfire impact a business’s revenue — with no physical damage requirement.

No other provider has built insurance solutions for these unmet needs to help small - and mid-sized businesses -- until now.

“The financial impacts of climate change are affecting businesses now, and the risks will only increase as the planet continues to warm.” – Michael Bloomberg, CEO Bloomberg LP